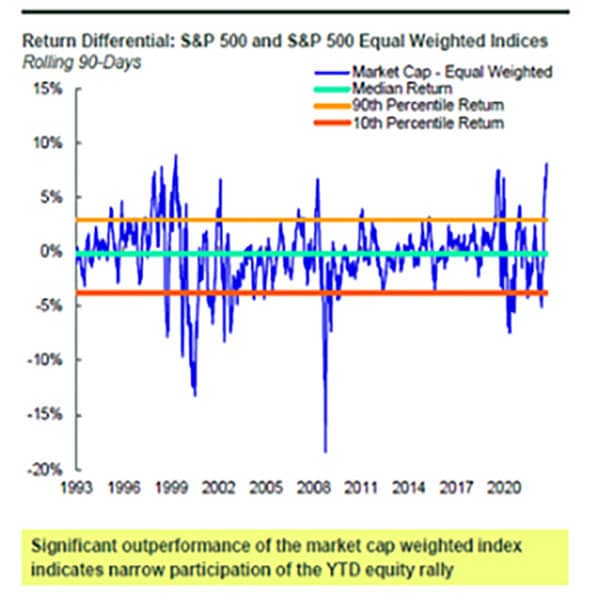

While we would typically think rising interest rates would result in lower stock valuations, stock markets have responded instead by bidding up stocks to higher multiples of earnings. Nowhere is this more on display than in the large cap growth segment of the market, with the emergence of artificial intelligence-based growth stoking market enthusiasm. We share excitement over AI, too. Nonetheless, we believe that many of these stocks have been bid up to prices that we struggle to justify, even under very optimistic earnings growth assumptions.

We fear that this divergence in valuations will end badly for many of these “go-go” names. Even so, we are finding more attractive investments in this environment than we otherwise might. While market multiples have surpassed 20x earnings, many pockets of value have emerged, Thus, our recent investments have been in attractive businesses trading at lower multiples than have been available for quite some time.

Admittedly, we have been more transactional this year than in most years for a couple of reasons. First, as previously mentioned, we think prices in the market are quite bifurcated. Growth and “quality” are trading at a large premium to the rest of the market, and their renewed favor may be stealing attention from other interesting areas of the market. While larger, faster-growing, higher-return on capital companies should trade at some premium, we are seeing as wide of a gulf as we have ever seen against the rest of the market.

As a result, we have been selling some stocks that we think are priced for perfection and replacing them with businesses that we believe are still high quality, but more modestly priced. We are cautious about owning a portfolio of high-multiple stocks with interest rates at higher levels than they have been for most of the last decade.

We have initiated positions in companies that, in general, are smaller than this year’s big market winners and operate in industries that are currently less in favor. Our new investments operate in industrial distribution, pharmaceutical safety/toxicity services, banking, health insurance and energy. Collectively, we believe that we have bought into a basket of attractive businesses, at favorable prices, for which we think the market has underpriced future business prospects.

We always welcome a discussion of your portfolio, financial needs or just the opportunity to visit. We are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment.

The Lawson Kroeker Team

Chad Clauser, Tom Sudyka, Bruce VanKooten, and Adam Yale.