– Every little kid on every road trip ever…

Investors are focused on when the current market decline will end. Unfortunately, unlike the parent driving the car to a destination, the markets do not have a defined destination. They are on an ever continuing journey with side trips, bumps and sometimes even breakdowns along the way. What we do know is that once the breakdown is fixed, or the side trip concluded, the journey will continue. How you are positioned for the journey is often more important than a focus on getting to the destination.

So how bad are things really? As we write, equities have continued their year-to-date decline with most major market indices falling into bear market territory (a decline of over 20%). Perhaps more concerning is the decline in fixed income markets due to rising interest rates. Simply put, bonds have not been the normal buffer to equities volatile ride this time. The negatives are repeated and magnified by news outlets using adjectives (such as debacle, torched, savaged, thrashed) that are meant to drive emotional reaction rather than intelligent thought. While global concerns (the Ukraine/Russia conflict, China lockdowns, and aggressive global central bank actions)

are real, the question today is whether these concerns are already reflected in market prices?

We find it interesting that in most aspects of life, everybody loves a discount. Whether it be an article of clothing, outdoor furniture, tickets to the theatre or your favorite food, a sale is likely to push a consumer to buy. However, whenever equities sell off, or ‘go on sale’, investors question (rightfully so) if now is a good time to buy. Like most investors, we are unable to predict the market bottom. What we can do is look for reasons good companies’ stocks are currently “on sale,” and might be mispriced enough to provide attractive future returns.

Interestingly, economic growth concerns dominate the current narrative, yet consensus earnings estimates have been resilient and in some cases continue to improve. Positive earnings growth will make current stock prices seem like bargains when looked at through a future rear-view mirror. Of course, if the earnings growth doesn’t materialize, the price may have been justified. A threat to positive economic forecasts is depressed

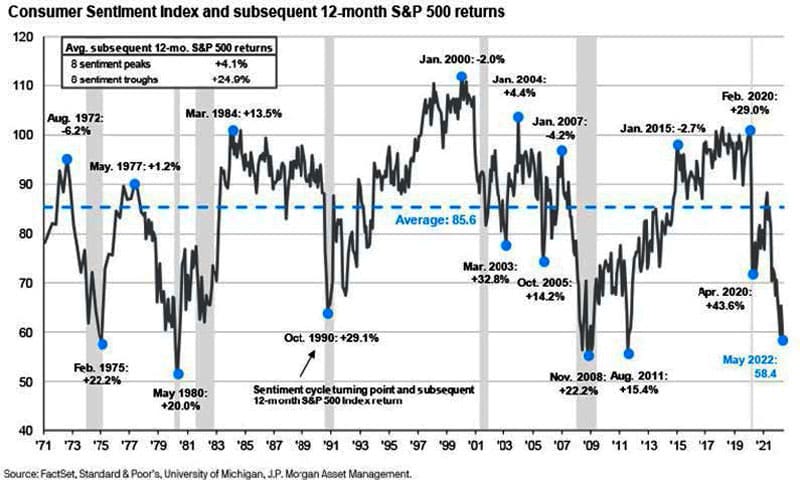

sentiment. Sentiment surveys from consumers, CEOs and investors are at record lows, which gives cause for concern as such views can lead to a self- fulfilling prophecy of recession. Conversely, it has historically been from the lows on such surveys that the greatest market returns have been generated. Current fears have historically proved overblown and market overreactions have been too severe.

It may seem counterintuitive but buying into a bear market has been a favorable trade for investors throughout history. In fact, in the 10 ‘bear’ market declines we have seen since 1950, if you bought on the day the S&P 500 crossed over a 20% decline, the S&P 500 has been up about 15%, on average, and has been positive 70% of the time one year later. Looking

at a more appropriate time horizon of three years after those bear markets, the S&P 500 has been up 90% of the time and about 10% annually. The times that this strategy did not work include the dot.com bubble and recession in 2001 and the housing bubble and subsequent recession in 2008—severe recessionary environments that do not seem likely today.

It has been an incredibly challenging environment to begin 2022, but our view is that the equity market has priced in a more pessimistic outlook than what may occur. As a result, while it is impossible to know if “we are there yet,” opportunities for long-term investors are more abundant than any time in the most recent past.